Headlines

FG Shelves $950m Eurobond Sale Over Unfavourable Pricing

By Derrick Bangura

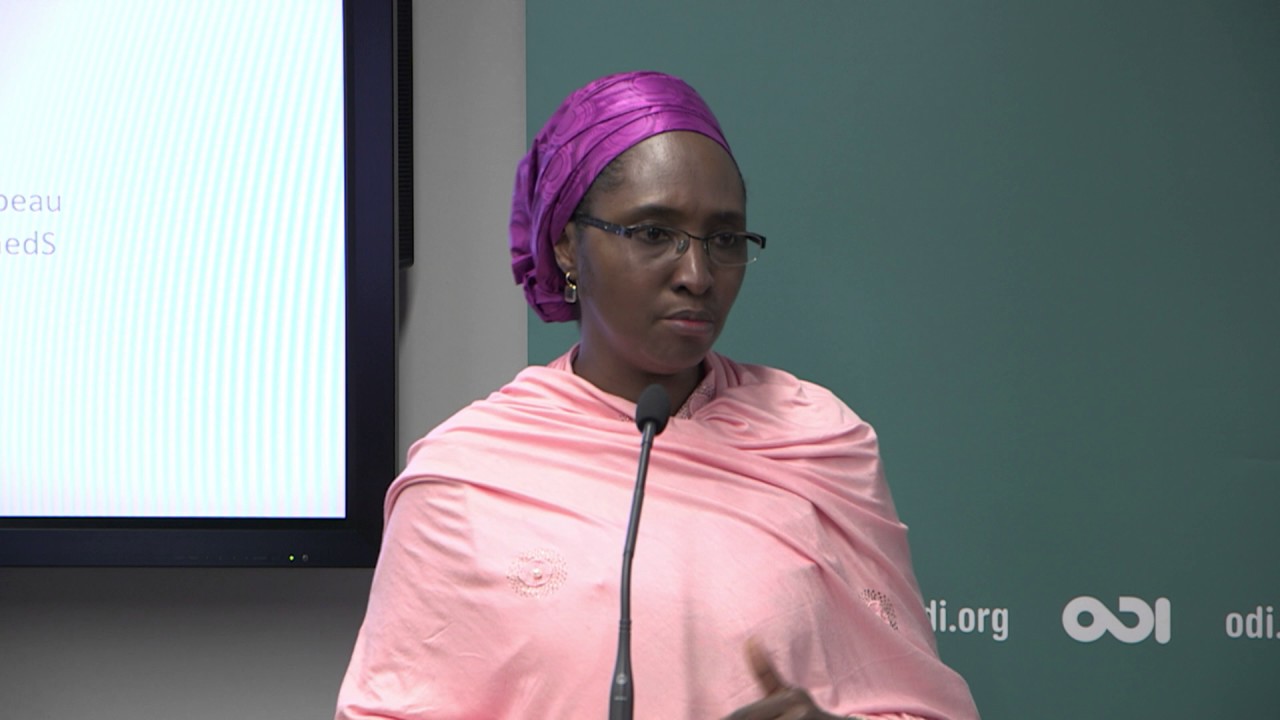

Nigeria’s federal government has suspended plans to raise about $950 million in overseas bonds, as a result of unfavourable market conditions during the timeframe approved for the fundraising, the Minister of Finance, Budget, and National Planning, Mrs. Zainab Ahmed has said.

It also responded to the forecast by the International Monetary Fund (IMF) that the country could be spending 100 per cent of its revenues on debt servicing by 2026, saying the prediction was based on wrong parameters.

This is as the Debt Management Office (DMO) has listed two new Federal Government of Nigeria (FGN) savings bonds for subscription at N1,000 per unit.

Ahmed had in April disclosed that Nigeria planned to sell in May its second external debt this year to help plug fiscal deficits. The planned $950 million bond sale would account for the balance of $6.1 billion in overseas borrowings planned for 2021 after it raised the second tranche of $1.25 billion in March.

However, the minister, who spoke on the sidelines of Islamic Development Bank meetings in Egypt, was quoted by Bloomberg on Saturday as saying “we were not able to do that because the market pricing was not good and also the approval period for us has closed. She added that “the approval period was up to May 31, 2022; so, we are not going to be able to take that one anymore.”

Nigeria was one of the first sovereigns to tap the Eurobond market after the start in late February of Russia’s war on Ukraine, which stoked commodity prices and inflation just as the US Federal Reserve raised interest rates. Nigeria’s seven-year bond in March was priced to yield 8.375 per cent, compared to a similar maturity raised about eight months ago with a coupon of 6.125 per cent.

The federal government plans to curb borrowing costs this year by using the International Monetary Fund’s general allocation of reserves known as special drawing rights to fund projects, then reducing external borrowings, Ahmed said. It projects N17.3 trillion ($41.6 billion) budget spending this year, with forecast deficits of N7.35 trillion.

“What we are doing now is to plan on managing our situation such that we are not exposed to increased costs in 2022,” Ahmed said. “We are hoping that in 2023 things will be much better than what we are projecting in 2022.”

Analysts said Nigeria’s return to the market at a time when investors are wary of volatility across financial markets shows the urgent need for Nigeria’s government to narrow its budget deficit. The IMF forecasts the gap will widen to 6.4 per cent of gross domestic product this year from a pre-pandemic average of 4.3 per cent, due to the rising cost of fuel subsidies.

Borrowers have been on the sidelines since Russia’s invasion pushed up funding costs. Turkey was the second sovereign to announce an overseas bond sale in April.

Nigeria’s deficit is expected to widen to 6.4 per cent of gross domestic product this year from a pre-pandemic average of 4.3 per cent due to the rising cost of fuel subsidies, according to IMF forecasts.

Meanwhile, Ahmed has also disclosed that the recent forecasts by the IMF that the country could be spending 100 per cent of its revenues on debt servicing by 2026 was based on wrong parameters.

She argued that the organisation’s assumption was hinged on the prediction that the country’s revenues would remain stagnant, explaining that it had indeed been improving.

Ahmed stated that Nigeria was confident that it would beat this year’s non-oil revenue target based on collections made in the first three months of the year.

The Bretton Wood institution had raised concerns over Nigeria’s fiscal conditions, adding that the nation spends 89 per cent of its revenue on debt.

The IMF’s Resident Representative for Nigeria, Ari Aisen, who spoke while presenting the fund’s latest Sub-Saharan Africa Regional Economic Outlook report, also warned that with fuel subsidy payments averaging N500 billion monthly, total expenditure on subsidy could hit a record N6 trillion by the end of the year.

But Ahmed said on the sidelines of the IDB meetings in Egypt that the rise in non-oil revenues would help the country avoid the prediction by the IMF that debt service would swallow all of the country’s income by 2026.

“The IMF projection is predicated on the assumption that revenue levels will stay the same as they are right now up to 2026,” Ahmed said.

She argued that non-oil revenues were outperforming income from crude oil, adding that taxes collected last year even exceeded projections.

“In 2021, our non-oil revenues outperformed our budget by an aggregate of 15 per cent.

“In 2022, our first quarter shows that already, the company income tax and Value Added Tax (VAT) are slightly above the projected target,” she added.

FG Lists Two New FGN Savings Bonds for Subscription

Meanwhile, the DMO has listed two new FGN savings bonds for subscription at N1,000 per unit.

According to the DMO, the first one is a two-year savings bond maturing on June 15, 2024, at an interest rate of 8.20 per cent per annum.

The second is a three-year savings bond due maturing on June 15, 2025, at a 9.20 per cent per annum interest rate.

“Offer opens on Monday, June 6, and closes on Friday, June 10; settlement date is June 15.

“They are offered at N1,000 per unit, subject to a minimum subscription of N5000, and in multiples of N1000 thereafter, subject to a maximum subscription of N50 million.

Headlines

Noble Ladies Champion Women’s Financial Independence at Grand Inauguration in Abuja

Women from diverse backgrounds across Nigeria and beyond gathered at the Art and Culture Auditorium, Abuja, for the inauguration and convention of the Noble Ladies Association. The event, led by the association’s Founder and “visionary and polished Queen Mother,” Mrs. Margaret Chigozie Mkpuma, was a colourful display of feminine elegance, empowerment, and ambition.

The highly anticipated gathering, attended by over 700 members and counting, reflected the association’s mission to help women realise their potential while shifting mindsets away from dependency and over-glamorization of the ‘white collar job.’ According to the group, progress can be better achieved through innovation and creativity. “When a woman is able to earn and blossom on her own she has no reason to look at herself as a second fiddle,” the association stated.

One of the association’s standout initiatives is its women-only investment platform, which currently offers a minimum entry of ₦100,000 with a return of ₦130,000 over 30 days—an interest rate of 30 percent. Some members invest as much as ₦1 million, enjoying the same return rate. Mrs. Mkpuma explained that the scheme focuses on women because “women bear the greater brunt of poverty” and the platform seeks “to offer equity in the absence of economic equality.”

Education is also central to the Noble Ladies’ mission, regardless of age. Their mantra, “start again from where you stopped,” encourages women to return to school or upgrade their skills at any stage in life. The association believes that financial stability is vital in protecting women from cultural practices that dispossess widows of their late husbands’ assets, while also enabling them to raise morally and socially grounded families.

Founded on the vision of enhancing women’s skills and achieving financial stability, the association rests on a value system that discourages pity and promotes purpose. “You have a purpose and you build on that purpose to achieve great potentials and emancipation,” Mrs. Mkpuma said.

A criminologist by training and entrepreneur by practice, she cautions against idleness while waiting for formal employment. “There are billions in the informal and non-formal sectors waiting to be made,” she said, rejecting the “new normal of begging” and urging people to “be more introspective to find their purpose in life and hold on to it.”

Mrs. Mkpuma’s management style keeps members actively engaged, focusing on vocational skills and training to prepare them for competitive markets. She is exploring “innovative integration of uncommon technologies” and is already in talks with international franchises to invest in Nigeria, with Noble Ladies as first beneficiaries.

The association’s core values include mutual respect, innovation, forward-thinking, equal opportunity, and financial emancipation. With plans underway to establish a secretariat in the heart of Abuja, the group aims to expand its impact.

The event drew high-profile guests, including former Inspector General of Police, Mike Okiro, and a host of VIPs, marking a significant milestone in the association’s drive for women’s empowerment.

Headlines

NEPZA, FCT agree to create world-class FTZ environment

The Nigeria Export Processing Zones Authority (NEPZA) has stepped in to resolve the dispute between the Federal Capital Territory Administration and the Abuja Technology Village (ATV), a licensed Free Trade Zone, over the potential revocation of the zone’s land title.

Dr. Olufemi Ogunyemi, the Managing Director of NEPZA, urged ATV operators and investors to withdraw the lawsuit filed against the FCT administration immediately to facilitate a roundtable negotiation.

Dr. Ogunyemi delivered the charge during a courtesy visit to the Minister of the Federal Capital Territory, Barrister Nyesom Wike, on Thursday in Abuja.

You will recall that the ATV operators responded to the revocation notice issued by the FCT administration with a lawsuit.

Dr. Ogunyemi stated that the continued support for the growth of the Free Trade Zones Scheme would benefit the nation’s economy and the FCT’s development, emphasizing that the FCT administration recognized the scheme’s potential to accelerate industrialisation.

Dr. Ogunyemi, also the Chief Executive Officer of NEPZA, expressed his delight at the steps taken by the FCT minister to expand the economic frontier of the FCT through the proposed Abuja City Walk (ACW) project.

Dr. Ogunyemi further explained that the Authority was preparing to assess all the 63 licensed Free Trade Zones across the country with the view to vetting their functionality and contributions to the nation’s Foreign Direct Investment and export drives.

“I have come to discuss with His Excellency, the Minister of the Federal Capital Territory on the importance of supporting the ATV to succeed while also promoting the development of the Abuja City Walk project. We must work together to achieve this for the good of our nation,” he said.

On his part, the FCT Minister reiterated his unflinching determination to work towards President Bola Ahmed Tinubu’s Renewed Hope Agenda by bringing FDI to the FCT.

“We must fulfil Mr. President’s promises regarding industrialization, trade, and investment. In this context, the FCT will collaborate with NEPZA to review the future of ATV, a zone that was sponsored and supported by the FCT administration,” Wike said.

Barrister Wike also said that efforts were underway to fast-track the industrialisation process of the territory with the construction of the Abuja City Walk.

The minister further said the Abuja City Walk project was planned to cover over 200 hectares in the Abuja Technology Village corridor along Airport Road.

According to him, the business ecosystem aimed to create a lively, mixed-use urban center with residential, commercial, retail, hospitality, medical, and institutional facilities.

He added that the ACW would turn out to be a high-definition and world-class project that would give this administration’s Renewed Hope Agenda true meaning in the North-Central Region of the country.

Barrister Wike also indicated his continued pursuit of land and property owners who failed to fulfil their obligations to the FCT in his determination to develop the territory.

Headlines

Benue IDPs block highway, demand return to ancestral homes

Vehicular movement along the Yelwata axis of the Benue–Nasarawa highway was brought to a standstill on Wednesday as Internally Displaced Persons, IDPs, staged a protest, demanding immediate return to their ancestral homes.

The protesters, believed to be victims of persistent attacks by suspected herdsmen, blocked both lanes of the busy highway for several hours, chanting “We want to go back home”.

The protest caused disruption, leaving hundreds of motorists and passengers stranded.

Eyewitnesses said the displaced persons, many of whom have spent years in overcrowded IDP camps, are expressing deep frustration over the government’s delay in restoring security to their communities.

“We have suffered enough. We want to return to our homes and farms,” one of the protesters told reporters at the scene.

Security personnel were reportedly deployed to monitor the situation and prevent any escalation, though tensions remained high as of press time.

Efforts to reach the Benue State Emergency Management Agency, SEMA, and other relevant authorities for comment were unsuccessful.

-

Headlines4 years ago

Headlines4 years agoFacebook, Instagram Temporarily Allow Posts on Ukraine War Calling for Violence Against Invading Russians or Putin’s Death

-

Headlines4 years ago

Headlines4 years agoNigeria, Other West African Countries Facing Worst Food Crisis in 10 Years, Aid Groups Say

-

Foreign4 years ago

Foreign4 years agoNew York Consulate installs machines for 10-year passport

-

News1 year ago

News1 year agoZero Trust Architecture in a Remote World: Securing the New Normal

-

Entertainment3 years ago

Entertainment3 years agoPhyna emerges winner of Big Brother Naija Season 7

-

Headlines2 years ago

Headlines2 years agoNigeria Customs modernisation project to check extortion of traders

-

Entertainment2 years ago

Entertainment2 years agoMovie download platform, Netnaija, announces closure

-

Economy2 years ago

Economy2 years agoWe generated N30.2 bn revenue in three months – Kano NCS Comptroller