Publishers Note

Musing on the PEF-PCNI Collaborative effort at Reconstructing Nigeria’s North-East

Since 2009, the North-East region of Nigeria has been ravaged by the Boko Haram insurgency which has resulted in the loss of lives, and the displacement of millions of people. Over two million residents of the North-East have fled their homes and are compelled to live in Internally Displace Persons (IDP) camps located in many States and some have attained refugee status across Nigeria’s.

borders. Consequent upon the violence associated with the Boko Haram crisis, extensive damage to social, economic, health, roads and other infrastructure have been witnessed. Returning the North-East to normalcy has been one of the prime priorities of President Muhammadu Buhari’s administration. One of the measures adopted to restore normalcy is effective reconstruction and rehabilitation of social and physical infrastructure.

Therefore, President Muhammadu Buhari directed all agencies of the Ministry and oil and gas operators to invest massively in the reconstruction and rebuilding of the North-East of Nigeria. The directive became imperative given the relevance of the region to Nigeria’s security. Violence from the region has been taking its toll on the peaceful coexistence of the Nation.

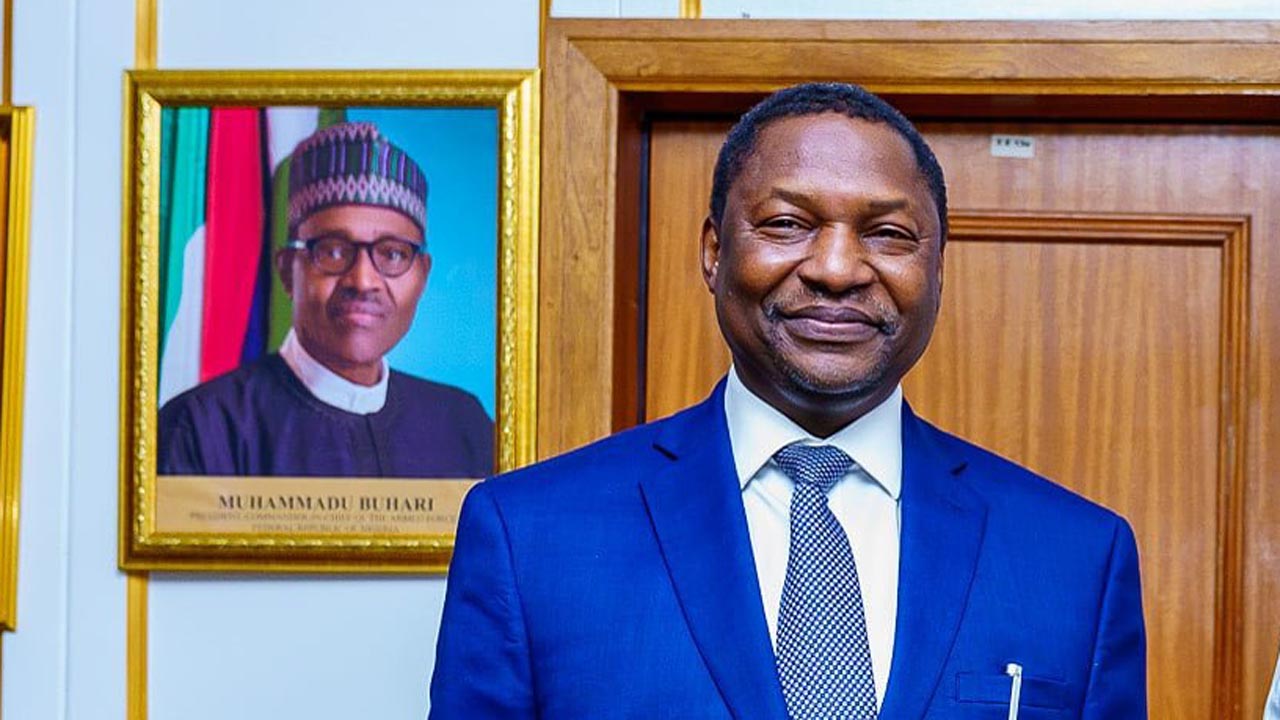

The Petroleum Equalization Fund after careful deliberations decided to work with the Presidential Committee on the North-East Initiative, PCNI, now known as the North East Development Commission, NEDC, which have the statutory responsibility of leading the reconstruction and development of Nigeria’s North-East. The impact of PEF interventions is perceived across the Nation. On the assumption of office in 2016, Mr. Ahmed Abubakar Bobboi brought his wealth of experience in the industry to bear.

His administration has been able to maintain and improve good relationship with stakeholders, especially in the downstream sector which is evidenced by the smooth distribution and availability of petroleum products nationwide. As the first homegrown staff to be appointed Executive Secretary of the Agency, Mr. Bobboi has over the years, encouraged self-development, capacity building, knowledge acquisition, discipline, accountability, efficiency and etiquette for improved job performance among his members of staff which has added value to the organization.

He is completely detribalized and bears no animosity against anyone. Attributable to his perspicacious achievements, his reappointment did not come as a surprise because his diverse experience and tenacity were glaring for all to see. He wasted no time in addressing the development of fit-for-purpose manpower to handle the ever-evolving dynamics of the downstream subsector. He is aware that the industry requires some important skill-sets going forward, and as a pragmatic visionary, he embarked on strategic staff training and development exercises, locally and internationally

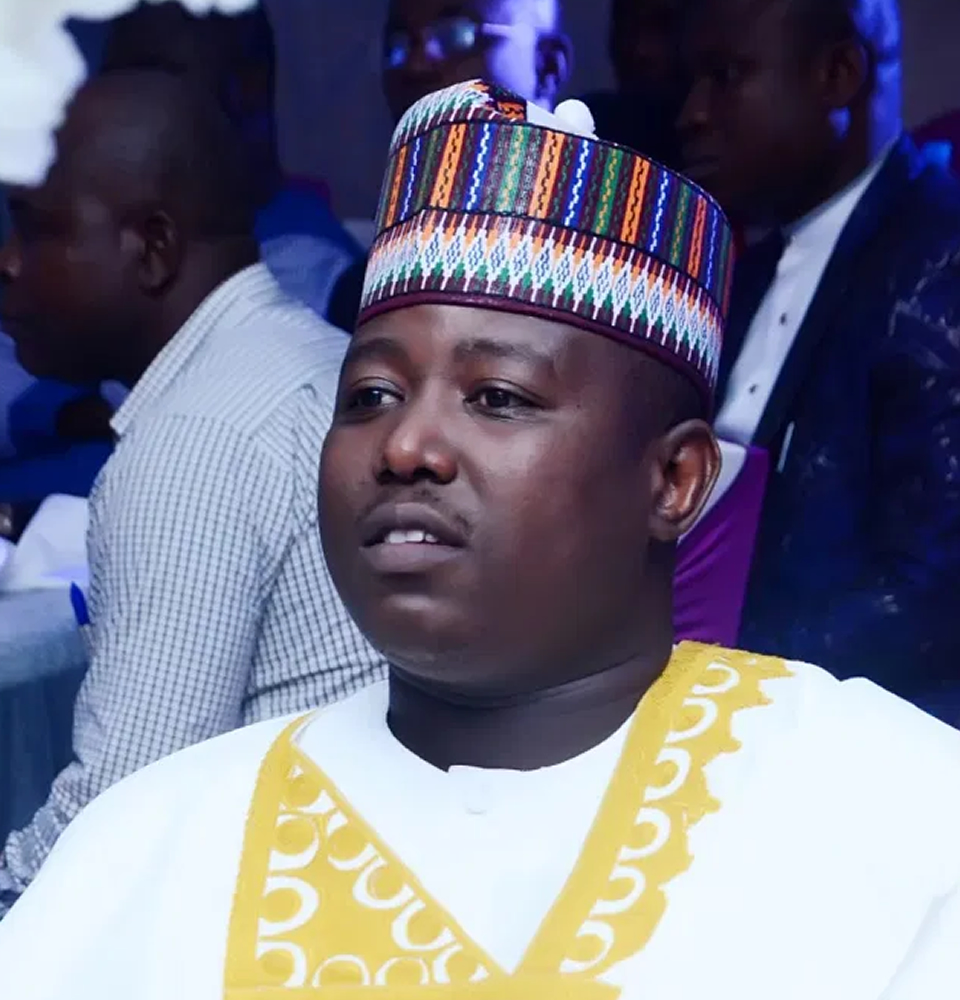

Jamilu Yusuf

Publisher

Headlines

NAICOM: light-speed improvements in the INSURANCE sector

It would take a lot more than coincidence for one man to serve as Director General and Commissioner/Chief Executive Officer all in one lifetime and in a country of over 200 million people, across 3 administrations. It simply requires the quality of being exceptional; being 1% of the top 1%. Mr Sunday Olorundare Thomas is an apotheosis of such superlative attribute. Mr Thomas is no stranger to leadership as he was Director-General of the Nigerian Insurers Association (NIA) between May 2010 and April 2017.

When Mr. Thomas took the reigns as substantive Commissioner for Insurance and Chief Executive Officer of the National Insurance Commission (NAICOM), on April 30, 2020, the country was getting a thorough bred administrator as well as an insurance expert extraordinaire. Trained in Actuarial Science and possessing an MBA in Finance, the NAICOM boss had the extra advantage of having worked his way through the Nigerian insurance ecosystem and achieved landmark excellence along the way.

Over three decades of premium insurance experience and expertise are what Mr Thomas came with and the results of his outstanding experience and skills are already perspicuous. The commission has experienced a reinvigorated planning structure and result-driven policy development system. Service delivery has also improved tremendously, as has customer protection and the confidence of investors and stakeholders.

His previous designation as Director-General of the Nigerian Insurers Association (NIA), an association considered a linchpin in insurance in Nigeria, provided him with the fundamentals of leading in the future in the capacity of Commissioner/Chief Executive Officer of NAICOM. His strategic policy reforms in market development, ensuring insurance penetration in the country, have improved the insurance sector in the country astronomically.

In the age of technology, the insurance sector in Nigeria was lagging at some of the most basic technologies requisite for functionality. The just completed portal had been under construction for the past nine years and only attained functionality under the current leadership. The organization has aligned with the Nigerian content policy and there is an expectation that this would increase the presence of insurance in the oil and gas sector.

Mr Thomas’ reign has witnessed light-speed improvements in the sector at micro and macro levels. There is a renewed vision for inclusion of everyday Nigerians from any social stratum to energize the economy and stimulate full-scale economy engagement. About six micro-insurance companies will be functional to this effect in the near future.

NAICOM is experiencing deepening localization of its activities and widening globalization of its standards. The 2021-2023 Strategic Plan has five goals designed to entrench effective and efficient service delivery, ensure safe, sound and stable insurance sector, adequately protect policyholders, and public interest, improve trust and confidence in the insurance sector and encourage innovation and promote insurance market development. All industry-based growth indicators accede to the competency and professionalism of Mr Sunday Olorundare Thomas and his technical team…

Jamilu Yusuf Yola

Publisher

-

Headlines4 years ago

Headlines4 years agoFacebook, Instagram Temporarily Allow Posts on Ukraine War Calling for Violence Against Invading Russians or Putin’s Death

-

Headlines4 years ago

Headlines4 years agoNigeria, Other West African Countries Facing Worst Food Crisis in 10 Years, Aid Groups Say

-

Foreign4 years ago

Foreign4 years agoNew York Consulate installs machines for 10-year passport

-

News1 year ago

News1 year agoZero Trust Architecture in a Remote World: Securing the New Normal

-

Entertainment3 years ago

Entertainment3 years agoPhyna emerges winner of Big Brother Naija Season 7

-

Headlines1 year ago

Headlines1 year agoNigeria Customs modernisation project to check extortion of traders

-

Entertainment2 years ago

Entertainment2 years agoMovie download platform, Netnaija, announces closure

-

Economy2 years ago

Economy2 years agoWe generated N30.2 bn revenue in three months – Kano NCS Comptroller