Insurance

Leverage AfCFTA to grow insurance sector, AIO president charges insurers

The President, Africa Insurance Organizations (AIO), Mr Tope Smart, on Tuesday, charged stakeholders in Africa’s insurance industry to leverage the opportunities offered by the Africa Continental Free Trade Area (AfCFTA) to grow the sector.

Smart said that maximizing the opportunity offered by the trade would grow the insurance sector across the continent.

He spoke in an interview with the News Agency of Nigeria (NAN) following his emergence as the new president of AIO at the recently concluded 47th AIO Conference and Annual General Meeting in Lagos.

Smart said that AIO is a microcosm of AFCTA, with the cardinal objective of promoting cooperation among Africans in the insurance business.

“So, with AfCFTA, the removal of trade barriers will lead to an increase in intra-African trade, which will lead to an increase in demand for insurance across Africa.

“My responsibility is to engage stakeholders in the insurance sector in Africa to take advantage of this initiative to grow the sector,” he said.

Smart, also Managing Director/CEO, NEM Insurance Plc, urged market operators across the region to share information and experience with one another.

He said that such information would enable receiving markets to advance the growth of insurance in their domain.

On the five-point agenda he rolled out during his investiture, the AIO president said he would address the issue of low consumer trust to increase insurance penetration.

“This is a major barrier to the growth of insurance in Africa but payment of claim obligations by operators as and when due will address this issue.

“My administration’s five-point agenda, if well pursued, would increase the rate of insurance penetration across Africa.

“Wherever I stop, having laid a good foundation, I expect my successor to continue from there in the interest of the insurance sector in Africa,” he said.

Smart described his emergence as president as a big honour to Nigeria, which last occupied the position about 21 years ago.

He said the position presented him with an opportunity to come up with some initiatives that would change the narrative about the practice of insurance across Africa.

“It will also give me an opportunity to correct some negative conversations around insurance practice in Africa,” he said.

The AIO president appreciated all stakeholders in the industry for the massive support he got during his investiture.

NAN reports that Kenya has been nominated to host the 2022 AIO conference, where Smart will hand over the baton to a new president.

Headlines

Experts seek key policies for MSMEs development

Experts on Monday underscored the need for key policy recommendations for Micro, Small and Medium Enterprises (MSMEs) development to focus on areas of financing, capacity and structure.

They gave the advice at a webinar organised by the Small and Medium Enterprise Group (SMEG) of the Lagos Chamber of Commerce and Industry (LCCI).

The News Agency of Nigeria (NAN) reports that the event’s theme is: “Ensuring SME Growth in a Challenging Economy.”

Mr Yomi Olugbenro, West Africa Tax Leader, Deloitte, stressed that these key areas would increase MSMEs contributions to the country’s Gross Domestic Product (GDP) and spur economy stability and growth.

Olugbenro said that a credible financial system enabled by technology was paramount for funding and operating efficient settlement systems for MSMEs survival in the near future.

He noted that in spite of the various global economic disruptions, Small and Medium Enterprises (SMEs) were expected to survive if only structural development could be established over time.

He also called for improved credit rating systems, expanded credit risks guarantees coverage, and a wider implementation of financing across major markets.

On structure, Olugbenro stressed the need for partnership with business consultants to provide SMEs with technical support and access to markets.

He also called for infrastructure based policies that encompasses efficient power distribution to different industrial clusters.

“We must also build the capacity of entrepreneurs by providing capacity building support services focused on training entrepreneurs on relevant skills.

“The national education standards must be revamped to drive early exposure to entrepreneurship, and improve entrepreneurship education in state owned institution.

“SME loan portfolio must also be diversified following a gender and sector agnostic strategy,” he said.

Dr Peter Bamkole, the Director, Enterprise Development Centre, said that a national survey during the COVID-19 pandemic revealed that 93 per cent of SMEs encountered several challenges which led to some businesses shutting down and downsizing.

He, however, noted that the seven per cent that thrived were businesses that were digitally enabled in their operations from raw materials sourcing to after sales services.

He stressed that henceforth, SMEs must be more collaborative among themselves, and reinvent their business models with operations carried out in a more efficient, innovative and creative manner for profitability.

“A significant number of those in the services sector should think of renewable energy to reduce cost of production.

“SMEs must add more value to their goods and services before exports, connect with SME across the continent to optimise the benefits of the Africa Continental Free Trade Area (AfCFTA),” he said.

Dr Michael Olawale-Cole, President, LCCI, said most recent conversations around the role, challenges, and growth opportunities for MSMEs underscored their importance as the engine of growth of any economy.

Olawale-Cole represented by Dr Chinyere Almona, the Director General, LCCI, noted that United Nations statistics revealed that MSMEs account for 90 per cent of businesses, 65 per cent of employment and 50 per cent of GDP worldwide.

He, however, posited that SMEs were now more than ever in need of support, as they navigate the impacts of the COVID pandemic, insecurity, supply chain disruptions, and the climate crisis.

He stressed that Nigerian policymakers must move beyond recovery and consider ways to lower and eliminate barriers faced by MSMEs, improve the business environment and access to special intervention finance, markets and technology in these fragile times.

He added that government must invest more in export infrastructure to ease the export of goods from Nigeria to the rest of Africa under the African Continental Free Trade Agreement (AfCFTA).

“In recent times, the Nigerian economy has suffered several shocks as a result of rising double-digit inflation rates; tepid growth; high unemployment, and even higher underemployment due to constrained productive activities and others.

“We still believe that these challenges can be fixed with the right mix of fiscal and monetary policies that promote targeted financing for the SME sector and intervention funding for manufacturers.

“The LCCI is also very interested in supporting SMEs in accessing funding opportunities by interfacing with local and international developmental finance institutions on behalf of our members.

“We reiterate our point that SMEs need special intervention funds targeted at supporting production, export capabilities, and building resilient supply chains,” he said.

Headlines

NAICOM, NAIC assure flood victims of prompt claim settlement

The National Insurance Commission (NAICOM) and the Nigerian Agricultural Insurance Corporation (NAIC) have assured prompt settlement of claims due to policyholders affected in the recent flood disaster across the federation.

Speaking on the development at an industry forum in Lagos, the Head of Corporate Communications and Market Development, NAICOM, Rasaaq Salami, assured affected policyholders of the commission’s commitment towards ensuring prompt settlement of claims by insurance companies.

READ ALSO: Buhari leaves for London for routine medical check-up

The Assistant General Manager of Corporate Services, Nigerian Agricultural Insurance Corporation (NAIC), Magdalene Omosimua, who also spoke, said: “NAIC sympathises with flood victims in the country. The corporation shares the pains and agony of victims and stands with them during this trying period.

“As a responsive organisation, we are using this medium to assure our insured clients that their genuine claims will be given utmost urgent attention to enable them to go back to living their normal productive lives.

“NAIC wishes to advise that property and business endeavours of our citizens be promptly insured to guarantee the sustainability of existing jobs, income stabilisation, food security, poverty alleviation and wealth creation.”

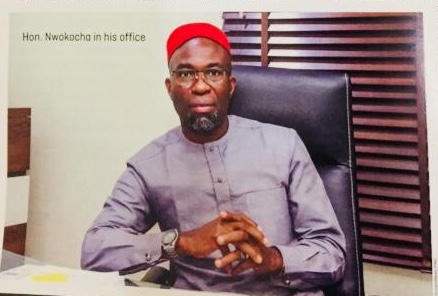

Cover Personality

Hon. Darlington Nwokocha is repositioning the Nigeria’s Insurance business environment

By Gwen C. Onyebuchi

Chairman of the House Committee, Honorable Darlington Nwokocha, has a long-standing collaboration with other stakeholders on the insurance amendment bill, 2020, which seeks to re-enact and consolidate the insurance Act 2003 with other existing insurance laws in Nigeria. Citing an instance, Nwokocha said that the third-Party Insurance Act of 1945 still has fines prescribed in colonial Pound Sterling instead of Naira.

The Economic and social benefits of the bill include; up-to-date supervisory framework, improved insurance confidence, regulatory efficiency, elimination of fake insurance policies, removing the huge Financial burden from government, enhancement of regulatory compliance, expansion in foreign direct investment, creation of additional jobs and stemming youths’ restiveness, aiding economic development through Financial Inclusion and reduced social pressure by encouraging credit lifestyle.

Darlington Nwokocha is a member of the Federal House of Representatives, representing the Isiala Ngwa North/South Federal Constituency of Abia State. Darlington was born in the year 1967 and hails from Isialangwa in the Abia State of Nigeria.

He attended Umunneise Secondary School, where he obtained the West African School Certificate (WASC) in the year 1985. In the year 1992, he obtained a Bachelor of Science Degree (BSc) from the University of Port Harcourt. He went further to obtain MSc, from Abia State University Uturu Okigwe. He also studied and obtained a PGDPA from the University of Benin in the year 2007.

Between the years 2007 and 2011, Darlington was a member of the Abia State House of Assembly. In the year 2011, he retained his seat in the statehouse of the assembly after the general election, a position he held until 2015 when he won the election to represent his constituency in the Federal House of Representatives.

In this interview, he believes that if all the necessary encouragement is gotten from the stakeholders and the system when the insurance bill is made law, it will re-revolutionize the Insurance industry in the next 5 years, then the academy and other aspects will be working, everyone involved will feel a good sense of relief to an extent and it will drive the insurance company and contribution to the nation’s gross domestic product (GDP).

Excerpt:

AccessNews: Could you please briefly introduce yourself and your work as chairman of the committee on Insurance and actuarial Matters and how has the journey been for you since the assumption of office?

My name is right Honourable Darlington Nwokocha, I speak for Isiala-Ngwa North, South Federal Constituency, and am from Abia state. Your constituency is the first thing that will bring you to the National Assembly before you will now be favoured to be given a position as the chairman or the deputy. In some cases, much in line with your wealth of experience, you will be asked to lead a particular committee. I have chaired so many ad-hoc committees, this is my second tenure at the National Assembly. I have spent eight years here, was a Principal Officer, Chairman of so many other committees, education, works, and e.t.c. I have spent the first four years and another one year plus in the National Assembly which means both the local and state politics and the national politics are within my balance. The House presently assigned me to chair the committee and insurance matters and the committee is a very large committee, large in the sense that if it is properly driven by the best international practice, every life and every activity and every infrastructure in Nigeria is supposed to be tied to insurances of some kind. That will help if leverage to create some level of flexibility in the entire economy instead of cash and carry which is what we adopt presently.

When I came in as a Chairman, I, reached the realization that insurance is one area that every person, material, and element needs.

I asked myself who are the Stakeholders in this industry, who are the regulators? The answer was NAICOM, which is the regulator of all insurances and businesses. I said okay, I had to call on the Acting Chairman then, presently the substantive Chairman, Mr Sunday Thomas. I inquired from him what had been done? What are his work points and what are his road maps? He tried to explain some factors and elements that have been a clog in the middle of the entire insurance business. I realized that to a very great extent, there were too many moribund or obsolete laws which if we engineered, will drive the process effectively; and you know one thing it is not all about laws alone.

If you provide a law that is just one aspect, if you provide a law that has a human face, it is just another thing, if you provide a law that will be quite admissible, it will help a particular situation to move faster and better. I realized that some of the laws, like the motor vehicle third party, marine, were laws with weak penalties. If you create a law that has no penalty, it’s not sanctioned able which means it’s as good as you make a statement without following up on it, and most of those laws rely on so many factors that you cannot implement in any way. So like the third party motor vehicle insurance we have today, you will understand that if you have a car, somebody will tell you please let me go and do insurance for you and the person will just move across the street, meet some people under the tree, they will bring a document that you cannot trace to a particular company, just for you to evade the police in one way or the other which is not how it is supposed to be.

Insurance is not all about receiving claims at the point where there is any misfortune. There are certain things insurance and insurance businesses put in a society and environment that can help guide even your psychological and mental state of mind. The insurance company will play its role in the sense that it tries to put precaution on any person they are insuring, and say please don’t do this. This is because, the less the incident or crisis or any miss-giving, the better for them. So they will always watch your back at all times to know and make sure that they will mitigate any action that will lead to them paying any claim.

So when I noticed that, I realized the best thing for me to do is for me to invite all stakeholders: the Nigeria Insurance Association, The Broadcast Association, The Vehicle Inspection Officers, VIO, etc. We designed a road map. I told them first and foremost that the road map is to access what they had been doing. The Head of the service, for instance, can come up and pay like 5 billion-plus in a year, saying that somebody is insured or the agencies and their staff are insured, at the end of the day whoever is insured is not even aware that he/she is insured, no data to show.

Ordinarily, in other climes if you are insured, you have a pin/number, you can trace the insurance company or call them for an inquiry and say, My name is this and that, Am I insured? They say yes or no.

When is my insurance going to expire? They tell you from this time to this time.

That will give you enough confidence as is a morale booster. It is a motivator to any staff that they are insured which means that if anything happens, their beneficiaries and benefactors will at the end of the day enjoy one or two compensations but that is not the case in Nigeria so all we needed is just to invite the Stakeholders, the Nigeria insurance association and ask, how have you been carrying out this your business? And you notice that it`s just who knows the other person that can give you business let him just pay back some funds.

Largely, what am saying is still a process, still in progress because there is an investigative hearing ongoing, so we have not come up with our report as of yet.

We invited the broadcast association because the media are the mediators between the insurance company and the insured, and asked how do you meditate? Do you know your co-mandates? What are your roles supposed to be? Have you been carrying out those roles the way you are supposed to in line with global best practices?

We met with them, at the end of the day, we noticed that there were many laxities and shortcomings. We concluded that the best thing we needed to do, after going through the laws was to consolidate all the Laws because they were in splinter groups. You find out that motor vehicles like the marine and NAICOM Act were in different batches. We decided to have a comprehensive bill to which one can refer to and be certain that it is an updated Act.

AccessNews: Let’s talk about the structures and recapitalization exercise? Talking about recapitalization is very key. Nigeria’s oil industry, for instance, is a very huge industry with most of its investments running into millions of dollars or billions of Dollars, there are no or very few companies that can take up the responsibility or pay for any claim from that sector in case of any uncertainty which means recapitalization is key for them to put their forms together and come up stronger than when they are operating from the individual point. There is always a room for insurance, outside where if you take a particular percentage you can warehouse the remaining outside the country but that notwithstanding, these all amount to capital flight. It is not always advisable to ship the remaining funds outside the country because that huge sum you are paying as a premium is something that would have been used here in the country to create employment and to create any other resources available. I decided that the best thing we needed to do is for us to look into the law and drive a more robust law that can stand the test of time and that is exactly what we have been doing. We have done the first reading, we are now in the second reading which means it is committed for a public hearing.

Then after that, we are looking at the third reading. One other thing is that NAICOM, which is the regulatory body, had already fixed a timeline to kick start the recapitalization process and are relying on stakeholders which means it may not give the external support the leverage to say okay if we work on this particular law, tomorrow if there is an issue, are we going to rely on the law that is obsolete to drive a particular process. So I told them that I feel the best thing is for us to have a stop card somewhere that will help hold on a little bit while we are still galvanizing the necessary strength around. We will see how we can tidy up the amendment and bring forth a better law that will make the best international practice. That is exactly what we are doing.

AccessNews: What are the changes that have been made in the regulatory environment and the expected impact on the industry?

The bill is principally trying to tidy up firstly the administrative arm of insurance that is the NAICOM and their regulatory powers.

Secondly, it is trying to look into motor vehicle insurance which is a third-party policy. You know that the motor vehicle if policy properly harnessed will revolutionize the insurance industry. It creates some sense of cautiousness because the insurance companies will have the role of talking to whomever they are insuring so that it lowers the risk of having accidents, the better for them. It is going to create a whole lot of employment, over a hundred thousand jobs because NAICOM and insurance companies will have offices in all the 774 local governments, they will have staff, that are going to reach out to people, they will be doing some sensitizations and training.

The law will create an Insurance training academy for people to be trained. It is just like in other climes, people understand that children have curriculum from primary school, secondary school and university where they are taught about health insurance, motor insurance, etc for you to know your right at all times. We are trying to do that. Presently, this law has provisions for education funds which are supposed to be managed by the NAICOM. They have a whole lot of funds they cannot make use of because they do not have a specific direction where they can channel those funds, they also do not have an existing academy, no curriculum in schools where people can say this is what we are learning about the insurance company. We want to open that window where we will provide it as a law where we can have at least for a start, one insurance academy in each of the geo-political zones and that as well will provide an opportunity to train the trainer. By the time the first set will come out, they can go back to their states to train some other people and if such things are structured in a way that the training continues and the curriculum imbibed in schools, from secondary school, everybody should know what insurance is all about because this cash and carry approach at all times when somebody smashes your car or health-wise, you must pay cash immediately does not help any economy.

The bank, for instance, when they did recapitalization, became flexible. Before the recapitalization process in the banking industry, it was a cooperate banking system where people will come and say this is the specific minimum required to open an account, but when they recapitalized and were going into the theory you can open an account with 1000 naira. Those years it was 20,000 naira and above for you to open an account, now with 200 nairas, you can open an account and it has opened the banking industry to make it stronger because what matters is not the huge amount, it is the participation of individuals in an industry that revolves the wheels of progress.

So that is what we want to do in the insurance industry where we put the motor vehicle, where we end up the fire insurance and building insurance, you can imagine a situation where a particular market is caught up in flames then they will go to the government, the money that would have been used to put the other infrastructure in order, they will use it to pay compensations.

When we have a viable insurance industry where every marketer or trader can pay five thousand naira (N5,000) and that money because there is a pool of funds, can serve. If there is any crisis, they can give you one million or two million naira compensation over time. Traders will not do that because they don’t have the awareness of the insurance industry, they are not well educated. People are not well educated in the concerns of that. So these are the things we want to see how we can fast track and make people understand what insurance is all about, where you have more than one story or two-story building during construction, you pay a little amount and that would help the entire process to get fully informed, these are the things we want to drive. In all aspects of the insurance to make sure we have a 360-degree effective insurance platform.

AccessNews: Coronavirus Pandemic has ravaged the global economic and financial sectors, thereby making it more difficult for the already underdeveloped insurance industry to grow and raise capital, also enormous destruction of both public and private properties has sparked worries on the ability of the insurance industry to cope with the expected amount of claims estimated at billions of Naira, how can the industry meet up?

Unfortunately, it would not have been nice for me to say that it was good that all these happened, but be it as it may, it already happened. Trying to re-emphasize the need for us to have an effective insurance industry because if these things never happened maybe we would have been foot-dragging all over. Presently, I know that I have started receiving some complaints and petitions from individuals. Though it is too soon, all the same, they have started complaining because people are afraid that those insurance companies may not be able to pay up whatever was lost.

There are tiny words, most of their agreement, there are things they call tiny words, we have people who may not understand the actual content of every information in all those tiny words, so I think, the law we are trying to bring forth will cure most of these things because the effect of this COVID and the aftermath of these protests have made it obvious that billions have been incurred and I have not seen any insurance industry, just very few of them that will be able to meet up with those claims. We are emphasizing that they have to because if they had recapitalized they team up with enough funds to make sure they address the issue once and for all. But since they are all individually driven, it will be difficult but we are still looking forward that maybe some banks and some other financial institutions could help them to drive hoping that over time they can rely on their financial stand to defray in future but I think we would still look into that as time goes on.

AccessNews: How many Insurance companies do we have at the moment in Nigeria, as of 2018 I know it was 62 and the number may have shrunk due to possible mergers/acquisitions?

We had 60 plus but we are still looking inwards, into that because some of them have not been able to pay their claims and I stand strongly and strictly that once you are not meeting up with the obligations, they should strike you out of the system. That is part of what we are investigating, at the end of the day most of them that will fall short of all these things will recommend that they remove them from the list of insurance companies.

AccessNews: What are the core challenges and issues that mark the activities and growth of the insurance industry in Nigeria and what would you identify as a sustainable solution?

The major problem is a lack of confidence in the insurance companies. Insurance is all about trust, and you must put trust in something for it to thrive. If for instance, Yusuf called me and said I will be here by 5:00 pm and he calls me again and I didn’t pick his call or I didn’t return the call by 6, 7, 10, till tomorrow morning and still didn’t return the call and nothing happened to me, if it happens two more times and happen to some other persons, I will see some level of irresponsibility, there won`t be any need for me to have confidence that this person can always wait for me whenever I call on him, that is exactly what is happening in the insurance industry, so many people have lost confidence. For this reason, things will happen, litigations and whatever. The insurance companies will come and bring up certain issues that were not there when the business was initiated, making it a zero confidence business here in Nigeria because some of the laws are not justiciable and sanctionable.

But if the laws are sanctionable where somebody will say you collected this thing and you told me this, let’s go to the court, you go to court for a case, and then it is handled and there is a punishment or penalty that is commensurate with whatever thing they have committed, you can imagine that some of the penalty is like 500 naira, 200 naira then some people will like to commit it over and over. When you are talking about businesses that have to do with millions then the penalty is 200 naira and above, there is no sanction, the person will tell you there is no problem, let us go ahead, even if I eat all the money nothing will happen because if you take me to court, I pay 500 naira and your millions have gone and if you go through the law and find out, is that what happens. The sanction, if I commit 500,000 naira offence is only 500 naira, I don’t want to go into that but if the sanction is commensurate with an anticipated offence, he tells them to let me go ahead and you see, in every business. There should be a clear-cut definition and a defined sanction at all times, in every continent, this is what it is and this is how it’s going to be.

There shouldn’t be any ambiguity, all those tiny lines should be removed, so that as you are going into the business even the Broker who is supposed to interface with the insurance company and the insured will clearly say “NO my client don’t go into this business”, see what these Tiny lines look at the meaning and on your own, you can research and it will be clear enough to you. There shouldn’t be any ambiguity.

Presently, there are few ambiguities because the law has not made it expressly clear that this is what it is supposed to be, that is why we are working hard to make sure that we remove all ambiguities to a great extent.

AccessNews: Are the National Health Insurance Scheme and the Nigeria Deposit Insurance under your office Supervision?

In the present structure of the House of Reps committee, because of the number of persons involved, most of these things are being handled by different persons. Ordinarily, everything related to insurance should be under one umbrella to give it a better standing but because of the number, they said that health should go to the committee on health. NSITF should go to labour and you know insurance falls into so many categories. We have NHIS that has to do with health. NDIC has to do with insurance finance and banking, NSITF has to do with labour, NIAC has to do with agriculture, every aspect of life is insurance. They were supposed to pull all of them together to be handled by an insurance committee but they have to structure it in a way that some other ones will fall into other areas.

AccessNews: Where do you see the Insurance Industry in the future?

This law has been lying idle for more than 15 – 18 years. There is one law that was enacted in the 1970s, that was the last time it was enacted during decrees. We believe that if we get all the necessary encouragement from the stakeholders and the system and they bring forth this law, it will re-rationalize this industry that in the next 5 years, by that time the academy and other things will be working, every person will feel a good sense of relief to an extent and it will drive the insurance company and the GDP will become awesome. So I look forward to seeing a better insurance industry in the future.

AccessNews: Your Final word for the youths and everyone else out there that have no faith in the Insurance industry?

I feel knowledge is power, it doesn’t necessarily mean that you must be literate for you to understand the rudiments of a particular thing, it’s just to show an interest if you don’t know, you ask. That is the reason for the kind of awareness we want to create concerning this particular law and insurance generally. I want a situation whereby the time we have an academy, we introduce into different levels of education curriculum, it will be translated in different languages so that people will understand what insurance is all about, that is very key, outside there you can hit somebody and the only thing you need to drop is your driver`s license, the person takes a picture of it and goes on to trace it.

If you are sick during emergencies, you don’t need to call anyone, they take you to any hospital and get your health insurance card and that ends it.

If you are a business person in the market, and you have issues, you don’t need to bother yourself because you have been paying your 20 naira or 20,000, somebody will come and compensate you for it. You want to import products and something happens along the line, you will be compensated. In every aspect of life, Insurance is key. Knowledge is power, you cannot give what you don’t have and you cannot key into what you don’t know because when you do that, people will take advantage of you. When you are quite knowledgeable about a particular situation, you will be so strong to define the way it has to go and rely upon and midwife the process effectively the way it ought to go.

-

Headlines4 years ago

Headlines4 years agoFacebook, Instagram Temporarily Allow Posts on Ukraine War Calling for Violence Against Invading Russians or Putin’s Death

-

Headlines4 years ago

Headlines4 years agoNigeria, Other West African Countries Facing Worst Food Crisis in 10 Years, Aid Groups Say

-

Foreign4 years ago

Foreign4 years agoNew York Consulate installs machines for 10-year passport

-

News1 year ago

News1 year agoZero Trust Architecture in a Remote World: Securing the New Normal

-

Entertainment3 years ago

Entertainment3 years agoPhyna emerges winner of Big Brother Naija Season 7

-

Headlines2 years ago

Headlines2 years agoNigeria Customs modernisation project to check extortion of traders

-

Entertainment2 years ago

Entertainment2 years agoMovie download platform, Netnaija, announces closure

-

Economy2 years ago

Economy2 years agoWe generated N30.2 bn revenue in three months – Kano NCS Comptroller