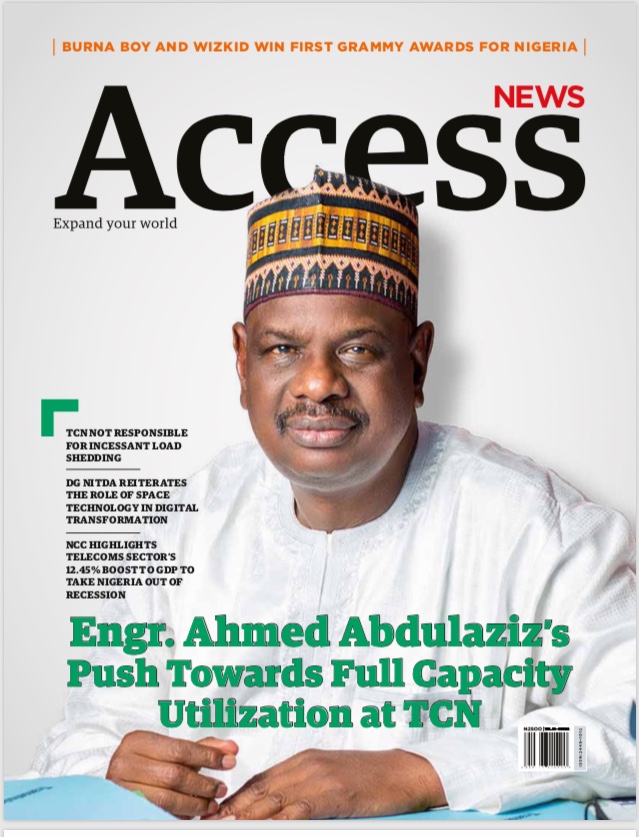

Cover Personality

Engr. Ahmed Abdulaziz’s Push Towards Full Capacity Utilization at TCN

Edited by Gwen C. Onyebuchi

A vast multifarious revivification of the Transmission Company of Nigeria (TCN) was the purpose for which new management was established, with the avid personality and consummate professional, Engr. Sule Ahmed Abdulaziz, as Managing Director/Chief Executive Officer of the TCN. Engr. Abdulaziz assumed office as TCN MD standing on 25 years’ experience obtained purely as he rose through the ranks in the power sector of Nigeria from Manager, Electrical after joining the defunct National Electric Power Authority (NEPA) in 1996, all through to the position of Regional Transmission Manager of Abuja Region, which he held until his appointment in an Acting capacity as TCN MD on the 19th of May, 2020.

Mr Abdulaziz, through his diverse work in the power sector, came on board with versatile experience evident from the manner with which the TCN executes her duties in recent times. Experiences drawn from Abdulaziz’s earlier work as Assistant General Manager, Substation Projects, were called to bear when a power grid collapsed in early 2021. The collapse represented the first time in just over six months of his appointment that any power grip had collapsed. That record was in itself magnificent. However, the more magnificent feat was that the TCN was able to restore the system back to optimal performance in all of 40 minutes after the collapse. This level of professionalism and responsiveness is the hallmark of consumerist demands of the power sector.

The continued impasse between the TCN and Discos in the sector was a marked vulnerability of the TCN in the past, a seemly devastating strain in the relationship of the TCN and other stakeholders was constantly criticized by watchers of the industry and professionals alike; end-users were the hardest hit in the end. The Abdulaziz management is clearly handling stakeholder engagements better with media interactions and explanative announcements about power outages and even apologies coming as firsts for a power sector formerly regarded as opaque to the greater extents.

The main statutory responsibility of the TCN is the transfer of electricity from generation to distribution companies, something that the AEDC accused the TCN of not achieving due to ‘inadequate system protection’. Abdulaziz, however, has assured Nigerians of a more robust grid and improved power transmission under his stewardship as well as maximum protection of the systems all over Nigeria. As clear action points, the MD has redeployed staff based on best-case efficiency indices and better liaisons with the Power Minister, Ministry of Finance, Customs and the Federal Executive Council (FEC).

Abdulaziz’s administrative excellence was also required in his engagement with contractors, some of whose projects have been left hanging for 10 years, and price renegotiation was done before they continued. The initiative has led directly to the accomplishment of TCN projects nationwide. Recently, the Gagarawa sub-station was commissioned. Sub-stations in Ikeja West, Lagos, Akure and Katsina are all awaiting commissioning. Mr Sule Ahmed Abdulaziz, a richly accomplished scholar, represents how appointments should be modelled going forward in Nigeria and the benefits of fixing profoundly experienced professionals in technical sectors of our economy.

AccessNews: Q1. Only a few weeks ago, the TCN issued a statement that GenCos and TCN were only producing quantum of energy in accordance with the demands from DisCos. Is it possible that the TCN is underutilizing its capacity?

ANSWER: Yes, TCN capacity is being underutilized due to load rejection or management by the DisCos. The installed capacity of the GenCos is about 12,000MW, though available capacity is much lower, the wheeling capacity of TCN today is about 8,100MW and the total distribution capacities of the eleven DisCos is about 5,500MW. That is not to say the GenCos or TCN do not have problems, of course, they do, but from the statistics, you will see that there are gaps between GenCos and TCN and between TCN and Discos which need to be bridged and we are all working together to bridge those gaps.

AccessNews: Q2. What other strategies do you intend to use in transmitting more power considering what we have now is not enough to go around the country and serve customers need adequately.

ANSWER: We would continue to build new substations and lines to increase our ability to move electricity in anticipation of more load up-take by the DisCos. Recently we completed some new transformers installation and lines reconductoring among other engineering works. Presently, several new transmission substations and lines are in the process of being awarded while efforts are in top gear to complete ongoing projects including reinforcement of existing substations and reconductoring of existing high voltage transmission lines for higher capacity.

We are religious about scheduled maintenance and have equally adopted modern technology such as the use of high-capacity conductors and stocking spare parts to ensure a drastic reduction in downtime.

AccessNews: Q3. Most times distribution companies attribute shortage of electricity supply to TCN how do you intend to address this challenge?

ANSWER: That is not the true situation. TCN has adequate transmission capacity to meet the immediate need of the DisCos. From the capacities of TCN and Disco I had earlier mentioned, you will know that our capacity is higher than that of the 11 DisCos however, both TCN and DisCos have just signed the Service Level Agreement in which the Discos nominates day-ahead, the capacity they want to distribute and indicate where they want it, and it is our duty to supply them as they requested, provided it is not below their MYTO allocation, I want to believe that such allegation does not exist anymore.

AccessNews: Q4. What are your short-term goals considering you are heading a company transmitting a highly sought after commodity with huge challenges?

ANSWER: Our goal in TCN is not different from that of the Federal Government for the company, as part of the value chain, which is to wheel stable and quality electricity to the nooks and crannies in the country. We have a graduate plan of improvement every six months and already we were able to reduce significantly the number of collapses in the country and at the same time, we are working hard to ensure TCN stands tall among its peers anywhere in the world. We are also particular about continuously improving staff welfare because as you said we are transmitting a highly sought after commodity, therefore we must have in place people who are willing to work.

AccessNews: Q5. How far has the TCN gone with the procurement of spinning reserves?

ANSWER: The procurement for the Spinning Reserve is awaiting approval from the Nigerian Electricity Regulatory Commission (NERC). Several meetings have been held between TCN and NERC in this regard.

Hopefully, soon NERC will approve the procurement of a reasonable level of spinning reserve.

AccessNews: Q6. How stable is the national grid?

ANSWER: The transmission grid has become more stable under my watch; this is because we have been intentionally proactive in dealing with several issues that may constitute a hindrance to the system, and have also undertaken several maintenance projects including spare part replacement, additional transformers installation, and are gradually revamping the entire system and of course we are doing these and much more with close attention to staff capacity building, which we have equally made priority.

We have also attempted to collaborate more with the DisCos by reinvigorating our interface team to help us nip in the bud, issues that might hinder system performance. The strict enforcement of the Grid Code as regards the Free Governor Mechanism for the GenCos and the gradually increasing uptake of more energy by the DisCos due to sustained pressure by TCN has equally helped in stabilizing the grid. We are doing so much more but I cannot completely speak on this without acknowledging that the Ministry of Power has given us a lot of support and the enabling environment to operate.

AccessNews: Q7. For some time now, there has been a minimal record of system collapse. What did you do to attain this record?

ANSWER: This was achieved through more rigorous enforcement of the rules by TCN through the NCC, also generating stations are complying more with free governor control of their generators. Bush burning under transmission lines have been reduced considerably through public enlightenment and rigorous mechanized line trace clearance. Our maintenance culture has also improved and staff are more motivated to give their best.

AccessNews: Q8. Is it true that you are upgrading in the National Control Center, Oshogbo, If true, what exactly are you upgrading in the centre?

ANSWER: Yes, we are in fact in the process of building two new National Control Centers at Osogbo and Gwagwalada. Also, the SCADA system is being upgraded and modernized. This will greatly streamline grid operations and optimize energy dispatch.

The two National Control Centers will be equipped with state-of-the-art grid control systems and all 132kV and 330kV substations fitted with substation Automation Systems for protection and remote control.

AccessNews: Q9. How much intervention has TCN received from its international development partners?

ANSWER: Currently, some TCN projects are funded through loans from four International Donor Agencies namely, the World Bank (WB), African Development Bank (AfDB), Agence Francaise de Developpment (ADB) AND Japan International Cooperation Agency (JICA) with a combined sum of 1.Ibn USD. The funds are addressing specific projects in the nation’s grid, within the various geopolitical zones of the country.

AccessNews: Q10. What are the challenges of the TCN at the moment?

ANSWER: There are some notable challenges in TCN which include the need for a very functional and efficient Supervisory Control and Data Acquisition (SCADA) system and Automated Meter Reading System, poor government budgetary allocation, delay in the release of the approved budget, bottlenecks in the processing of IDEC and other port clearing documents and difficulty in acquisition of land and Right of Way for our projects.

AccessNews: Q11. Has TCN recorded any achievement since the new management took over

ANSWER: Yes, TCN has recorded a number of milestone achievements in the last 10months to include the successful transmission of an all-time peak generation of 5,801.6MW in March this year and recorded the highest daily energy peak of 119,471.15MW. Re-conductoring Sokoto-Birnin–Kebbi line from 70MW to 120MW, Ikeja West-Alimosho-Ogba-Alausa lines from 120MW to 240MW and awarded the reconductoring of Onitsha-New Haven line from 680MW to 1,320MW.

330kV Sokoto-Birnin–Kebbi Line

- The company has also added 246MW at 132/33kV levels by the completion of 1x100MVA, 2x60MVA, 1x60MVA and 1x30MVA projects at Ogba, Gagarawa, Rumuosi and Iseyin substations respectively, among others.

2x60MVA Gagarawa Transmission Substation, Jigawa State

- TCN has successfully reduced the frequency of system collapse in the last 8 months by ensuring grid stability by recalibration and reconfiguration of transmission lines and transformers protection schemes which were prone to frequent system disturbances by setting up a functional protection department in the head office and also resolved a number of way-leave/Compensation issues across the country that have lingered for many years. Contracts and projects which are under litigation and stagnated have also been resolved.

- We have also made progress in its donor-funded projects by the World Bank (WB), African Development Bank (AfDB), Agence Française de Development (AFD) and Japan International Cooperation Agency (JICA), at different stages of implantation among which is the Abuja Ring Project funded by AFD expected to address green fields transmission lines and substations aimed at Reinforcing the High-Voltage Transmission Ring around Abuja, among others.

Cover Personality

Olorundare Sunday Thomas: NAICOM’s light-speed improvements in the Insurance Sector

Olorundare Sunday Thomas’ appointment as the substantive Commissioner for Insurance and Chief Executive Officer of the National Insurance Commission (NAICOM), became effective April 30, 2020; having been appointed in acting capacity in Aug 2019 following the expiration of the tenure of Mr. M U Kari, the former Commissioner for Insurance.

Before this appointment, Thomas was the Deputy Commissioner in charge of technical matters at the Commission between April 2017 and August 2019. Mr. Thomas is a thorough-bred insurance professional with vast knowledge and experience in underwriting, regulation, and hands-on management of human and material resources spanning over four decades uninterrupted.

During these years, Mr. Thomas had traversed the entire insurance sector in Nigeria leaving indelible marks along the way. It is instructive to note that Mr. O. S. Thomas (as widely known) who served as Director-General of the Nigerian Insurers Association (NIA) between May 2010 and April 2017, brought his experience to bear on the job. It is to his credit that the Association successfully developed and deployed the Nigeria Insurance Industry Database (NIID) platform.

He holds a BSc (Hons) in Actuarial Science and an MBA in Finance both from the University of Lagos. He is also an Associate Member of the Chartered Insurance Institute, London and Nigeria, Member Society of Fellows of the CII London, Member, Nigeria Institute of Management among others.

With strategic policies and plans, driven to enhance market development, efficiency in service delivery, protection of consumers as well as stakeholder confidence in the insurance business, the industry has not only seen improved rating but keying to launch into new growth areas and levels.

When he was appointed substantive commissioner for Insurance by President Mohammadu Buhari, on the 3rd of May 2020, having been the Deputy Commissioner in charge of technical matters since 2017, many no doubt believed in his ability to bring in changes that would elevate the status of the sector.

Like an industry analyst described him, “Thomas has been properly seasoned for the task on hand, having served in the Commission for close to three decades and rose steadily to become the Director Technical, a position from which he retired with infallible track records of achievements. His appointment as the Director-General of the Nigerian Insurers Association (NIA) after leaving NAICOM gave him more penetrative insight into the activities of the Association, regarded as one of the critical cornerstones of the insurance industry in Nigeria before providence railed him back to NAICOM as the Deputy Commissioner in charge of Technical before his present position.”

Mr. Thomas has proven he can be relied upon; having successfully begun the drive to increase insurance penetration and market development in the country.

Mr. Thomas has promised to bring insurance services to all nooks and crannies of the country, stating that the 2021-2023 Strategic Plan has five goals designed to entrench effective and efficient service delivery, ensure a safe, sound, and stable insurance sector, adequately protect policyholders, and public interest, improve trust and confidence in the insurance sector and encourage innovation and promote insurance market development.

“We also know that with the engagement we have had with the Nigerian content, there is going to be an increase in the oil and gas business. As I speak now, we have a committee working on the guidelines to enforce the law in the Nigerian content. All the leakages we have had hitherto will be blocked,” Mr. Thomas said.

On the need to expand the basket the NAICOM boss said, two Takaful insurance companies have been licensed in addition to the existing two, adding that the Commission is conscious of the fact that the insurance sector is knowledge-based which informed the ongoing development of more actuarial analysts capacity in the industry as the first step of having more qualified actuaries in the country.

“We know that the drivers of the economy are those at the lower levels of the pyramid and so we are taking financial inclusion very seriously. It is now a national policy. For the insurance sector, we are far behind, but we are doing a lot of catching up. To this effect, four micro-insurance companies have been licensed and an additional two are on the verge of being licensed”

It is no news that the Nigerian Insurance Industry has been struggling to get its constancy among the financial service providers in the country’s economy. The liability can be assigned to diverse reasons, among them, recession, abhorrent belief system, unprofessional practices by administrators, distrust, disrepute, and, obviously, inadequate guidelines and control.

These hindering variables have restricted the extent of insurance industry development in the nation when contrasted with its counterparts in different climes where the insurance industry is the turn of financial development and social adjustment.

Although the industry’s operators and the controller seem to have put their fingers on these militating factors against its development, the pathway for conquering the difficulties appears to have been cast for certain troubles.

Numerous administrators, comprised of insurance guarantors, Brokers, Loss Adjusters, Reinsurers, and Agents have had an intermingling of perspectives about their assumptions and criterion for better guidelines from the public authority administrative office of the National Insurance Commission (NAICOM).

There is a contention that what the industry had seen before the appearance of the current administration could be likened to a burial ground stillness, because of what they viewed as “brutal administrative remedy” occasioning a frosty connection between the administrators and NAICOM.

For example, on the Insurance Brokers side, a large number of the administrators have needed to battle with immense fines and punishments for minor infractions, justifying the Nigerian Council of Registered Insurance Brokers (NCRIB) to concoct a mediatory stage to diminish the hazardous approaches towards its members.

Additionally, protection financiers have their story of burdens to tell from comparative fines and punishments from the Commission.

Much as it is important to disinfect the business and mend it of its pollutions, administrators maintained the point of view that guidelines ought to be with a superior human face to have the ideal impact.

The icy cold connection between the controller and the administrators was very obvious in the considered lawful cases planned sooner or later by the NCRIB against the Commission on the proposed execution of the States Insurance Providers (SIP) seen by Brokers as a passing toll to their generally delicate presence.

Additionally, the protection guarantors in a confidential meeting examined the choice of the Commission on its order on the Tier-based capitalization in court.

The climate in the industry has become more accomodating, with the desire for all the more consistent advancement because of a better working relationship and comprehension of the activities in the industry under the current authority of the Commission.

Lately, the Commission has been associated with more cordial and logical guidelines without the standard thing “director student relationship” that it was noted for.

Counsel appears to have now turned into the standard between the controllers and the administrators for a superior industry. Although the business, especially guarantors had been on the hotness concerning the requirement for them to fulfill the time constraint for recapitalization at first set for June 30, 2020, around from the Commission demonstrated that “following a survey of recapitalization plans by the administrators and different levels of the consistency noticed” the deadline was extended to December 31, 2020, a move that has received commendation from a cross section of administrators, monetary administrations specialists and investors.

Many were of the view that the underlying June 31, 2020 deadline had put the guarantors on the edge since they saw it could prompt loss of functional benefits, giving more deductions to the generally delicate condition of the protection business.

It is believed that the new system would eliminate the delay associated with the restoration interaction which regularly obstructs their focus on the center assignment of developing their organizations and go about as a disincentive to their expert practice.

While the difficulties of developing the Insurance industry through the determined indictment of the law on necessary insurance and guaranteeing financial inclusion across the industry are confronting the Commission, the current style of administration of the Commission is probably going to take the industry to its ideal objective. As a useful advance to accomplishing sectoral embrace of Insurance, it is encouraging that NAICOM had as of late been drawing in crucial partners, for example, the Lagos Chambers of Commerce and Industry (LCCI), held gatherings with Insurance Directors consistently with different insurance customers in the nation.

Since it is generally expected that the buck rests on leadership, regardless of whether positively or negatively, considerable credits need to go to the Commissioner for Insurance, Mr. Sunday Thomas for applying the Midas touch towards regulating the business on his assumption of office.

It is pertinent to note that Mr. Thomas has been appropriately prepared for the assignment, having served in the Commission for near thirty years and rose consistently to be appointed for the position of a Director Technical, a role from which he retired with reliable histories of accomplishments in his path.

Most certainly, his role as the Director-General of the Nigerian Insurers Association (NIA) after leaving NAICOM gave him more penetrative understanding into the activities of the Association, viewed as one of the basic foundations of the insurance industry in Nigeria before fortune railed him back to NAICOM as the Deputy Commissioner accountable for Technical before his current position.

No question assuming the current climate of harmony, agreement building, and compassion that have portrayed the tasks and attitude of NAICOM towards insurance administrators perseveres, it would simply involve time for the insurance industry to encounter the much-wanted sustainable development, for which incredible credits would go to the current authority of the Commission under Sunday Thomas and his amiable team.

Insurance as a technology-driven business achieved a feat during the period under review. The Commission completed the first phase of its portal. The portal started nine years ago, but until last year, nothing was happening. Today, the functioning portal is already up and running.

In an attempt to increase insurance penetration in the country as well as increase government participation in the insurance business, Thomas said the Commission is currently engaging state governments to draw them closer and bring the gospel of insurance to their doorsteps. In the last year, some states governors have been visited by the Commission, he said.

On the enforcement of compulsory insurance, the Commissioner stated that NAICOM has embarked on various engagement measures across the country. Aside from visiting state governments to solicit for their support, NAICOM is also working in collaboration with the Federal Road Safety Corps, Federal ministry of transportation, Federal Fire Service, among others.

Cover Personality

Nigerian Singer, Davido raises N151m day after posting account details on Social Media

Nigerian singer David Adeleke (a.k,a Davido) has raised more than N151. 4 million after he shared his account details on his social media platforms on Wednesday.

As seen on his official Instagram handle @davido, his bank details as at Thursday showed a total sum of N151, 458, 030. 52 in his account.

The global star after opening a Wema Bank account on Wednesday posted it on all his social media platforms and called on his friends to donate one million naira each ahead of his 29th birthday which is Nov. 19

He wrote: “If you know I’ve given you a hit song…send me money… “una know una selves ooo,” he initially wrote on Instagram before adding his account details, “David Adeleke.”.

“Omo N7m in 10 minutes keep goin!! I love y’all! aim na N100m, I wan clear my Rolls Royce from port abeg.”

“I know say una love me but una love me like this. Omo nah like joke I start this thing oh, N26m,” he wrote. Meanwhile, it has been naira rain for the music star as some fans also joined the donation train.

The development has sent Nigeria’s social media agog, with comments and reactions causing social media traffic.

Some prominent businessmen, philanthropists and musicians also made donations into his account.

With the donations, Davido is said to have become one of biggest socialite and social media influencer in Africa.

Cover Personality

Communications Minister, Pantami Becomes Professor of Cyber Security

Minister of Communications and Digital Economy, Dr. Isa Ali Ibrahim Pantami has been promoted to the rank of Professor of Cybersecurity.

Pantami is among seven Readers (Associate Professors) promoted to Professor by the Governing Council of Federal Univerity of Technology Owerri (FUTO) at its 186th meeting held on Friday, August 20, 2021.

Other promoted from Readers to Professor are Engr. Dr Okechukwu Onyelucheya of Chemical Engineering, Dr. Alex I. Opara (Geology), Dr. Conrad Enenebeaku (Chemistry), Dr. Chikwendu Okereke (Geology), Engr. Dr. Lawence Ettu (Civil Engineering) and Dr. Godfrey Emeghara (Maritime Management Technology).

The Council also approved the recommendation of the Academic Staff Appointment and Promotions Committee (Professorial) for the promotion of nine Senior Lecturers to Readers and two Senior University Librarians to Deputy University Librarians.

An erudite scholar of information technology, Pantami who recently bagged the Security and Emergency Management Award (SAEMA) on Cybersecurity had lectured at Abubakar Tafawa Balewa University (ATBU), Bauchi, on ICT, before joining the Islamic University of Madinah as Head of Technical Writing in 2014.

He was appointed the Director-General and CEO of the National Information Technology Development Agency (NITDA) in 2016, before he was appointed the Minister of Communications and Digital Economy on 21 August 2019.

A senior lecturer at the FUTO told PRNigeria that the university committee is excited to have Pantami as one of its new seven Professors, even though the Minister as indicated that he would not receive remuneration because of his current position.

“We gladly welcome this new set of Professors, in our reputable institution. It is even more heartwarming to note that Prof. Pantami has already communicated to the University that he won’t collect salary for now because of his national assignment.

“As you are aware Professorial title on an individual connotes leadership and exceptional contribution at national and international levels in research, scholarship, teaching/mentorship and learning.

“In Nigerian Universities, a professorial appointment has been a prerogative of the Senate of the Universities. Because of autonomy, the criteria for the appointment of a professor varies from one university to another.

“A criteria for appointment of a professor is usually a process unless strong evidence indicates some waiver. The professorship is not a theory, but a practical aspect; an expert with the ability to profess his expertise in his field/profession.

“The procedure for appointment and conferment of a professor is annual and include an application by suitably qualified individuals through recruitment or promotion.

“The application is internally assessed by a panel of assessors (mostly professors) usually by the relevant members of a Senate standing committee of Appointment and Promotion (A&PC) of the University.

“Upon the committee’s positive assessment, the University may communicate to the applicant his appointment to the professorial position subject to a positive assessment of External Academic Assessors (usually three, one of which may be a reputable professor in Europe or North America).

“These External Assessors are independent of the applicant and are of professorial standing in a discipline related to the applicant’s core research and academic interest.

“The referees must not have supervised or collaborated with the applicant on any research/scholarly projects as well as must not be related whatsoever to the applicant.

“Therefore, in summary, appointment and promotion to a professorial position is a process and varies from university to university. University Senate is the final approving body for the conferment of professorial title on applicant and has also the power to waive certain criteria to confer the title when they are convinced that the applicant is qualified to have the title,” he said.

-

Headlines4 years ago

Headlines4 years agoFacebook, Instagram Temporarily Allow Posts on Ukraine War Calling for Violence Against Invading Russians or Putin’s Death

-

Headlines4 years ago

Headlines4 years agoNigeria, Other West African Countries Facing Worst Food Crisis in 10 Years, Aid Groups Say

-

Foreign4 years ago

Foreign4 years agoNew York Consulate installs machines for 10-year passport

-

News1 year ago

News1 year agoZero Trust Architecture in a Remote World: Securing the New Normal

-

Entertainment3 years ago

Entertainment3 years agoPhyna emerges winner of Big Brother Naija Season 7

-

Headlines2 years ago

Headlines2 years agoNigeria Customs modernisation project to check extortion of traders

-

Entertainment2 years ago

Entertainment2 years agoMovie download platform, Netnaija, announces closure

-

Economy2 years ago

Economy2 years agoWe generated N30.2 bn revenue in three months – Kano NCS Comptroller