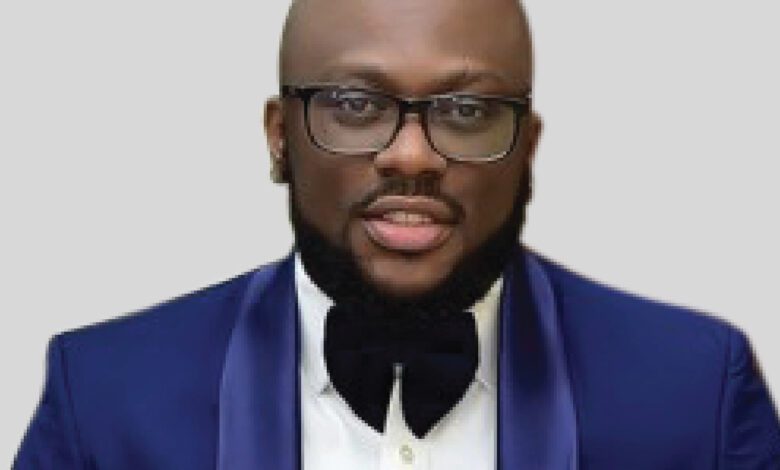

An “agropreneur’’, Mr Kenneth Obiajulu, on Friday in Lagos commended the Securities and Exchange Commission (SEC) for regulating fund investments in the agriculture sector.

He told the News Agency of Nigeria (NAN) that it was heart-warming that SEC and other regulatory agencies had developed a robust framework to regulate activities of companies masquerading as investment vehicles.

“We are happy that SEC and other regulatory authorities have developed a robust framework to regulate these companies.

“This will create a semblance of sanity in the sector,’’ he said.

Part of the framework was announced by SEC when it declared that rules governing “crowd funding’’ business in Nigeria came into effect on Jan. 21.

It directed all investment crowd funding portals and digital commodities investment platforms to note the requirements and eligibility criteria for raising funds or operating a crowd funding portal.

SEC also directed affected companies to comply with the registration requirements or cease operations by June 30, failing which they would be categorised as illegal and attract regulatory sanctions.

“Crowd funding’’ is the practice of funding a project or venture by raising small amounts of money from a large number of people, typically via the Internet.

“Crowd funding’’ is a form of crowdsourcing and alternative finance.

Obiajulu expressed regrets that Nigeria was replete with different platforms about starting agriculture-technology companies. He said he already counted more than 150 of such companies masquerading as investment vehicles.

“A lot of these companies believe agriculture is 80 per cent technology and 20 per cent actual getting dirty and doing the actual agriculture. They have no technical understanding and or experience in running an agricultural company.

“They are fascinated about the notion of being called entrepreneurs, forgetting that it takes hard and consistent work.

Obiajulu, whose company produces, processes and exports spices, raised 17.5 million dollars in Series A funding on Sept. 2, to upscale its processing capacity to 7000 metric tons.

The funds were contributed by three companies. The lead contributor provided 11.5 million dollars in equity while the two other investors provided working capital financing.

NAN